5 Ways to Manage FX Risk in Multinational M&A Deals

Foreign exchange (FX) fluctuations can have a significant impact on multinational mergers and acquisitions (M&A), influencing everything from valuation and deal structure to financing, post-merger integration, reporting and compliance. In today’s volatile global economy, a few basis points in FX movement can be the difference between a value-accretive deal and one that erodes shareholder returns.

Foreign exchange (FX) fluctuations can have a significant impact on multinational mergers and acquisitions (M&A), influencing everything from valuation and deal structure to financing, post-merger integration, reporting and compliance. In today’s volatile global economy, a few basis points in FX movement can be the difference between a value-accretive deal and one that erodes shareholder returns.

For corporate legal teams, outside counsel and deal professionals, managing FX exposure isn’t just a treasury issue; it’s a strategic imperative that requires alignment across finance, tax and legal functions well before a deal is negotiated.

How FX Impacts Cross-Border M&A

Currency movements create both opportunity and risk in any cross-border deal. The key areas of influence include:

- Valuation volatility: Shifts in exchange rates between signing and closing can materially alter the purchase price or impact fair value assessment.

- Deal structure and financing exposure: Currency mismatches between debt servicing and target cash flows may distort earnings projections.

- Post-merger integration complexity: Payroll, vendor and intercompany contracts often span multiple currencies, which can complicate consolidation and forecasting.

- Regulatory and reporting obligations: Local accounting and tax rules (e.g., ASC 830 / IAS 21) require consistent FX treatment and disclosures.

- Geopolitical and policy risk: Sanctions, capital controls and regional monetary interventions can disrupt transaction timing and fund movement.

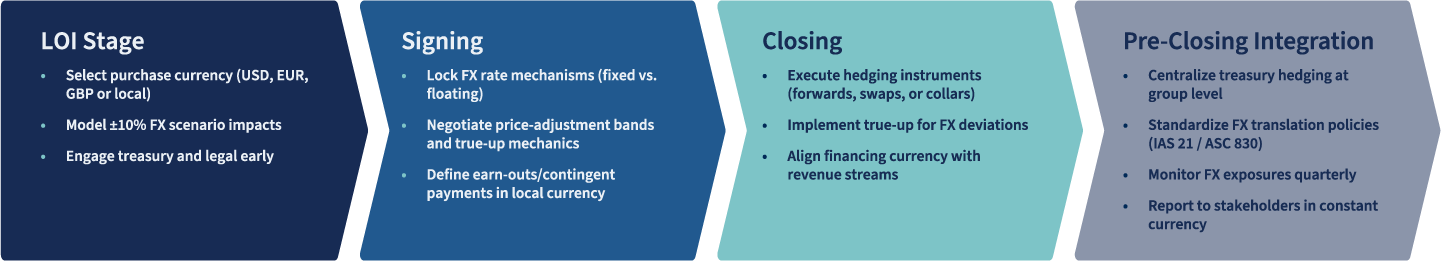

FX Risk Across the Deal Lifecycle

Managing foreign exchange risk requires attention throughout the deal lifecycle—from pre-signing through post-closing integration.

Pre-Deal

Before negotiations advance, buyers and sellers should align on how FX risk will be handled. Early decisions on transaction currency, rate methodology (fixed or floating) and hedging approach provide stability. Due diligence should include reviewing the target’s functional currency, historic FX exposure, and local conversion or repatriation restrictions.

Deal Structuring and Financing

Transaction documents should clearly allocate currency risk through price adjustment clauses or earn-out structures. For cross-border earn-outs, payments in the local operating currency help align incentives and protect both parties. On the financing side, natural hedging, or matching acquisition debt with target revenue currency, can reduce exposure. Multi-currency facilities, cross-currency swaps and preferred equity structures offer added flexibility.

Post-Closing Integration

Once the deal closes, treasury and finance teams must maintain consistent FX management across jurisdictions. Centralizing treasury operations enhances hedging efficiency, while constant-currency reporting helps stakeholders evaluate true operational performance. Regular hedge reviews ensure agility as markets shift.

Your FX Playbook: Top Five Actions to Mitigate Risk

Managing foreign exchange exposure requires early coordination between legal, finance and treasury teams. These five actions help ensure currency volatility doesn’t undermine deal value or create post-closing surprises.

- Set FX Policy Early

Define FX parameters at the letter of intent (LOI) stage, including agreeing on transaction currency, rate treatment and risk allocation. Establishing a shared policy upfront reduces disputes and provides a foundation for consistent valuation and hedging decisions.- Best practice: Document the FX policy as part of the LOI or in a side schedule to guide both legal and treasury teams.

- Engage Treasury and Legal Together

FX considerations affect contract language, financing documents and corporate structure. Joint planning ensures purchase price adjustments, earn-outs and repatriation terms reflect a unified approach.- Best practice: Create a cross-functional team (legal, tax, treasury) to review FX assumptions across deal documents early in the process.

- Model Currency Scenarios

Incorporate FX sensitivity analysis, typically ±5-10% swings, into deal modeling. This helps quantify valuation and cash flow impacts and identifies whether hedging instruments should be used.- Best practice: Include FX sensitivity results in board presentations to transparently frame risk and reward.

- Clarify Adjustment Mechanics

Many disputes arise when contracts don’t specify how FX affects closing adjustments. Define the reference exchange rate, tolerance bands and treatment of hedge gains or losses directly in the agreement.- Best practice: Include examples in schedules to make adjustment logic clear and enforceable.

- Plan for Day 1 Integration

FX management doesn’t end at closing. Ensure payroll, vendor payments and intercompany funding can operate across currencies without liquidity gaps or conversion losses.- Best practice: Develop a Day 1 FX funding plan detailing key currencies, repatriation flows and hedge approval processes.

How Agile Legal Helps Manage FX Risk Across the Deal Lifecycle

Foreign exchange risk touches every stage of a cross-border transaction—from initial valuation and structuring through financing and post-closing integration. Agile Legal works alongside corporate counsel, finance and treasury teams to ensure that these considerations are embedded into the legal and operational fabric of the deal.

Our multidisciplinary team:

- Reviews and drafts FX-related provisions in M&A agreements.

- Coordinates due diligence around local currency, capital flow and tax constraints.

- Aligns treasury and legal strategies for financing and repatriation structures.

- Supports compliance with multi-jurisdictional reporting and disclosure standards.

With deep experience in complex cross-border entity management and transaction support, Agile Legal helps clients mitigate currency exposure, maintain compliance and protect value creation, no matter where the deal takes place.

Strategically Structuring Multinational M&A Deals

FX risk is one of the most underestimated variables in cross-border M&A. When managed proactively, it can be a predictable, controllable variable. Legal, tax and finance leaders who address currency early in the transaction process protect valuation integrity, avoid costly surprises and demonstrate operational sophistication to investors and regulators alike.

Ready to treat FX management as a strategic component of deal planning? Contact us to learn how Agile Legal can help you develop a sound approach to FX in your next cross-border transaction, so it’s not a post-closing afterthought.

.jpg)

.jpg)